who do i call about a state tax levy

Review Comes With No Obligation. Ad Remove IRS State Tax Levies.

Do You Know The Criteria For Registration Under Gst Act Get To Know More About Such Interesti Goods And Service Tax Goods And Services Accounting And Finance

If you are unable to find any contact information you can call the IRS directly at 1-800-829-1040.

. Resolving your federal tax liabilities with your citymunicipal tax refund through the. Liens are filed with the county Register of Deeds andor the Secretary of State as security that a debt will be paid from proceeds when a taxpayer sells real or personal property. Submit a State Offer in Compromise.

Get Your Free Tax Review. Ad Remove IRS State Tax Levies. We connect you with a team of tax experts and.

The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance. When applicable you will receive a notice from the IRS containing your rights of appeal in the event your state tax refund is levied. Who do I call about a state tax levy.

No Fee Unless We Can Help. A levy is made by taking possession of property upon service of a warrant of levy on a person who is in possession of any property of a taxpayer. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance.

There should be a contact number on the form notifying you about a potential levy. A levy against currently held contract payments and future payments to an individual or entity that has assessments andor tax liens due to the SCDOR. Who do i call about a state tax levy Sunday July 3 2022 Edit.

No Fee Unless We Can Help. An IRS levy permits the legal seizure of your property to satisfy a tax debt. For the status of your state tax.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. An IRS tax levy is a legal seizure of your property to compensate for your tax. Ad Stand Up To The IRS.

Get Your Free Tax Review. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for. Quickly End IRS State Tax Problems.

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most. Call us today for a free consultation and to get more. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

How do I contact the IRS about a levy. A property tax levy is the right to seize an asset as a substitute for. A tax levy is a legal seizure of your property by the IRS or state taxation authorities.

All amounts up to the total amount due. It is different from a lien while a lien makes a claim to your assets. Omni Tax Solutions is here to help.

You dont have to face your state tax levy problem alone. It can garnish wages take money in your bank or other financial account seize and sell your. Review Comes With No Obligation.

Ad We Can Solve Any Tax Problem. Trusted Reliable Experts. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing contact the IRS right away. Pursuant to Section 7-1. For more information you may call the IRS at 800 829.

Ad Use our tax forgiveness calculator to estimate potential relief available. Trusted Reliable Experts. Ad Use our tax forgiveness calculator to estimate potential relief available.

Irstaxdebtresolution Tax Problems Merit Professional Help When Individuals Cannot Pay Tax Liabilities Of 10 000 Or More T Irs Taxes Tax Debt Tax Relief Help

What Is Tax Loss Harvesting Small Business Tax Deductions Business Tax Deductions Tax Time

Ca Ipcc Gst Question Bank Online Lectures Online Classes Constitution

In Addition To The Federal Estate Tax With A Top Rate Of 40 Percent Some States Levy An Additional Estate Or Inheritan In 2022 Inheritance Tax Estate Tax Inheritance

Gst Invoice Format Meteorio Pins Invoice Format Invoice Inside Sample Tax Invoice Template Australia 10 Invoice Template Word Invoice Format Invoice Template

Tax Company Web Design Tax Refund Tax Services Web Design

Download Policy Brief Template 40 Brief Executive Summary Ms Word

All About Gst Composition Scheme 3 3 Turnover Limit Input Credit Returns Faq Composition State Tax Schemes

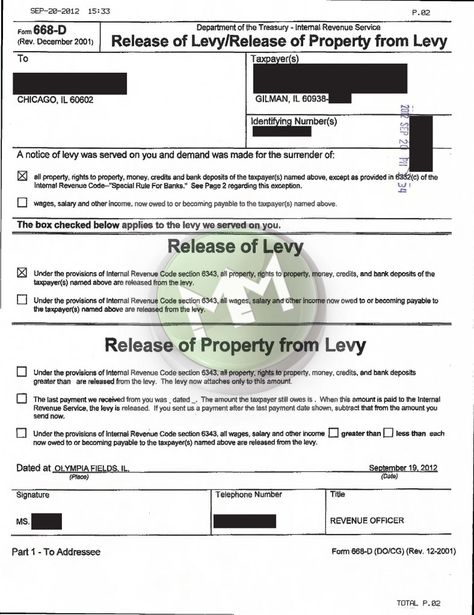

Irs Levy Release Gilman Illinois Mmfinancial Org Irs Taxes Payroll Taxes Irs

As You Can See Releasing A Tax Lien Has A Multitude Of Nuances And Variables To Consider The Actions And Strategies Are Depe Tax Debt Debt Help Debt Reduction

Why Not Get Rid Of All Taxes State And Federal Remove Private Health Subsidy Medicare Levy Negative Gearing And Capital Gains Tax And Increase The Gst To 12 Accounting Jobs How

Pin By Niseeth Kumar Palakkal On Economics Lessons In 2022 Accounting Training Learn Accounting Economics Lessons

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Lev Business Tax Income Tax Cost Of Goods Sold

Irs Installment Agreement Chesapeake Va 23324 Mm Financial Consulting Inc Irs Taxes Payroll Taxes Irs

Direct Taxes V S Indirect Taxes In India Ebizfiling Com Indirect Tax Directions Tax

Irs Notice Do S Don Ts Strategic Tax Resolution Llc Irs Finding Yourself Lettering